Hello {{ First_Name | reader }} 👋🏼

This edition read time: 8-10 minutes

Today we cover:

Omnibus drama unfolds, leaving businesses in limbo

Trump exits Paris Agreement, cuts DEI, weakens bribery law

Extreme weather and social risks top investor concerns

EU considers major CBAM rollback, exempting most companies

Mining & Metals must step up on biodiversity, and more.

REGULATORY UPDATE

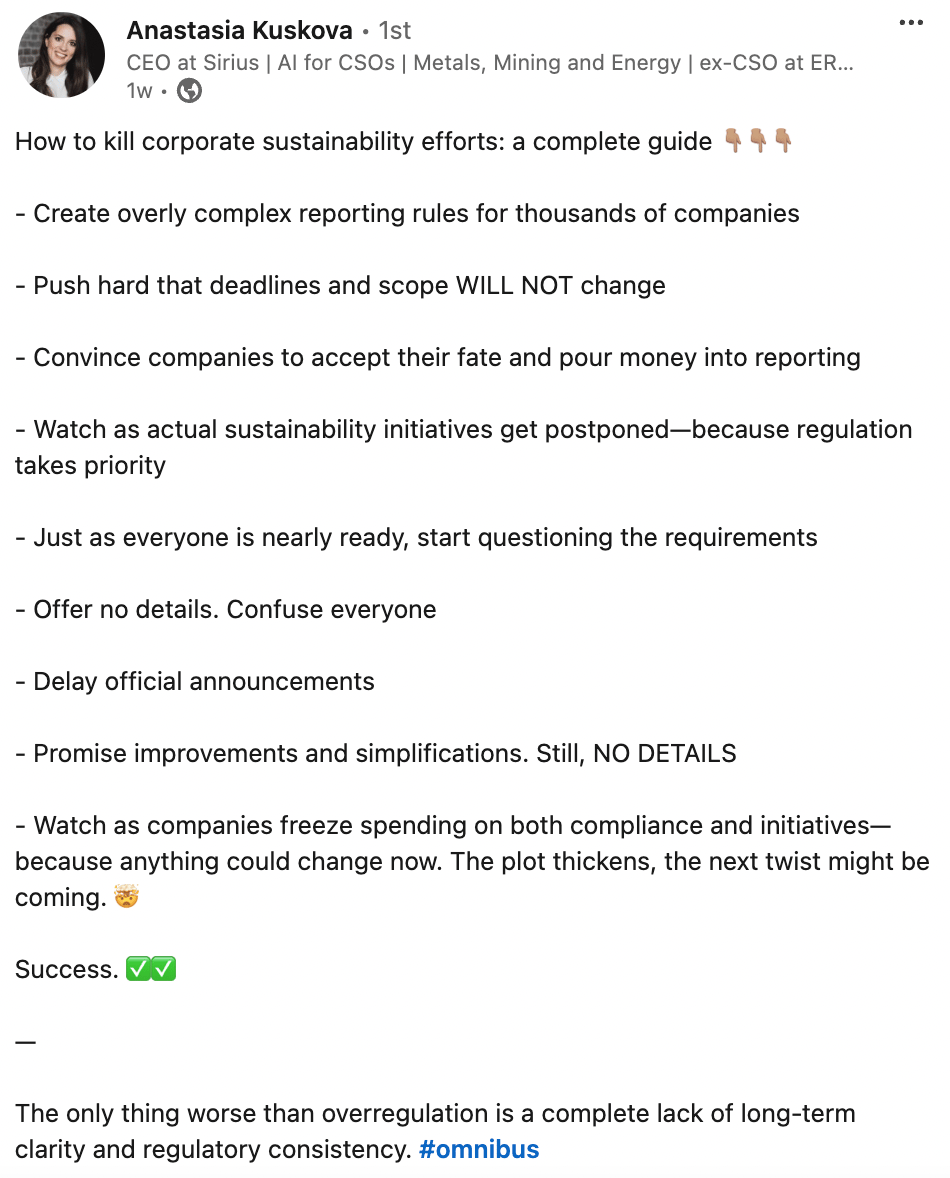

EU Plans Major Cuts to Sustainability Reporting

The European Commission unveiled its Competitiveness Compass, a strategy to boost Europe’s productivity, with a focus on AI, biotech, and affordable clean energy. A key component of this plan is the infamous Omnibus - a major regulatory simplification effort aimed at cutting sustainability reporting burdens under CSRD, CSDDD, and the Taxonomy Regulation.

Strong reactions from all sides have fuelled uncertainty. Investors managing $6.6 trillion have openly opposed the changes, warning they could undermine years of ESG progress. SMEs are left questioning whether to continue investing in compliance. Meanwhile, the EU is potentially delaying its formal announcement from February 26 to an unspecified date in March, leaving companies in limbo.

My take on this in this post 👇🏽

Trump Moves Fast: Exits Paris Agreement, Cuts DEI, and Eases Bribery Laws

In his first days back in office, Trump wasted no time reversing key policies:

Paris Agreement Exit – The U.S. is officially pulling out again, this time on an accelerated timeline. The move disrupts global climate efforts, cuts funding for developing nations, and creates regulatory uncertainty for businesses on international markets.

DEI Cancelled – An executive order eliminates diversity, equity, and inclusion (DEI) programs in federal agencies and pressures private organisations to follow suit, with many, including Amazon, Accenture, and Google, already scaling back their initiatives. Analysts warn this could lead to increased workplace discrimination lawsuits.

Bribery Law Weakened – Enforcement of the 1977 law banning U.S. companies from bribing foreign officials is being loosened. The administration argues it harms the competitiveness of American companies abroad. International organisations call this a major step backward in global anti-corruption efforts.

Plastic Makes a Comeback – A new order encourages federal agencies and consumers to buy plastic drinking straws, reversing efforts to reduce single-use plastics.

It’s an eventful start, to say the least 🍿🍿

First CSRD Reports Are Out

Despite the chaos around disclosures, industry leaders have pushed forward - Vestas, Novo Nordisk, Maersk, Ørsted, and others have published their first CSRD reports in the past two weeks. While the effort is enormous, reading the reports makes it clear that inconsistencies in auditor reviews, unclear materiality assessments, and impact disclosures persist, and comparability remains a challenge.

Great breakdown from Maria Tymtsias on what’s working (and what’s not) here.

CBAM ESSENTIAL UPDATES

EU Considers Major CBAM Exemptions

The European Commission is considering a significant scale-back of CBAM, potentially exempting up to 80% of companies initially targeted. New findings show that 97% of emissions covered by CBAM come from just 20% of companies, prompting a shift toward focusing on major emitters rather than smaller businesses.

The proposed adjustment aims to ease administrative burdens while keeping climate objectives intact. This move aligns with the EU’s broader push to simplify regulations and boost competitiveness - but raises questions about enforcement, revenue impact, and fairness for companies that have already invested in compliance. Expect further debate as policymakers try to balance climate ambition with industry concerns.

The unconstructive rhetorical question from a side observer: why wasn’t this 80/20 analysis part of the impact assessment that took several years before CBAM’s introduction?

KEY REPORTS

WEF: Mining & Metals Must Step Up on Biodiversity

Biodiversity is quickly moving up the industry agenda - something we expected for 2025. The World Economic Forum’s latest report, Nature Positive: Role of the Mining and Metals Sector, outlines how the industry can adapt while keeping up with demand for critical minerals, projected to rise 4–6x by 2040.

The report highlights five key areas for action: minimising environmental impact while maintaining output, tightening water use controls, scaling up recycling to reduce reliance on virgin materials, making land restoration a standard practice, and increasing industry-wide collaboration on biodiversity and ESG targets.

WEF estimates these actions could create $430B in annual value by 2030. With biodiversity gaining momentum, now is a good time to build internal strategy and alignment before regulatory and investor pressure inevitably catches up.

MSCI’s latest report on Climate Trends to Watch highlights shifting investor priorities. With 84% of market participants expecting extreme weather to cause serious economic damage over the next decade, climate adaptation is becoming a key risk factor, reshaping how investors assess corporate exposure and resilience. Social risks are gaining traction in equity markets and now carry significantly more weight than a decade ago - an area long overshadowed by climate concerns. AI’s data challenges are raising new questions, and as public funding for the energy transition slows, private capital is stepping in as a key driver of climate investments.

Green Digest Launches Sustainability Leader Interviews

Our favourite newsletter, Green Digest, is launching a series of interviews with sustainability leaders - CSOs and beyond. A much-needed look at the people behind the work: practical, real, and personal reflections from peers, bringing a stronger sense of community. The first one features Sorouch Kheradmand, Global Head of Sustainability at Schneider Electric - read it here.

If you’ve got insights to share with the most-read sustainability newsletter, let me know - I’d be happy to recommend you!

SIRIUS NEWS

Sirius at Mining Indaba

Just back from Investing in African Mining Indaba, where I spoke on a panel with Microsoft, Michelin, and BCG about what it really takes to implement AI fast - and actually see results.

From left to right: Yandi Mini (BCG), Anastasia Kuskova (Sirius), Joseph Starwood (Microsoft), and Hein Venter (Michelin)

Indaba is always a standout: of course, for the scenery and the unforgettable Anglo American Gala Dinner (Cape Town in February 😍), but also for the focused, no-nonsense discussions. RBA, RMI, IRMA, LME teams, and of course, Estelle Levin & Levin Sources brought sharp insights on responsible sourcing and transparency in value chains.

It’s one of those events that supports industry progress through dialogue and open discussion on complex issues. Watch our chat with the Indaba team, recorded ahead of the event, here.

59% More ESG Questionnaires - How to Keep Up

In the last quarter of 2024, our clients faced a 59% surge in ESG questionnaires - and Sirius hit record platform usage as teams worked to keep up. This demand hasn’t slowed down, and we’ve made it even easier to manage responses and collaborate across teams.

What’s New:

Improved Collaboration Tools - Request input from colleagues without providing access to the platform, track responses in real time, and reduce follow-ups.

Smarter Asset Manager - Add new products, sites, and entities easily to keep responses precise and aligned with evolving requirements.

If your team is dealing with the growing volume of ESG requests, join our next live platform walkthrough or request a tailored demo to see how Sirius helps industry leaders cut manual effort by 70% while keeping you ahead of customer and regulatory demands.

WHERE TO FIND US NEXT?

2nd Global Steel Sustainability Europe 2025

📅 February 26-27 (Frankfurt, Germany)

PDAC 2025

📅 March 2-5 (Toronto, Canada)