Hello {{ First_Name | reader }} 👋🏼

This edition read time: 8-10 minutes

Today we cover:

Billions in critical minerals bets: Anglo + Teck merge, US commits $1B to localize supply chains

Sustainability Outlook 2025: prove value or get cut

Spain makes climate emergency relevant to the business

CBAM wont be delayed, feedback window open

Essential new tools for mineral value chain due diligence, and other news

KEY UPDATES

Anglo + Teck: $53B copper bet

Anglo American and Teck will combine into a ~$53B copper group (Anglo ~62%, Teck ~38%), creating the world’s largest copper producer and the biggest mining merger since Glencore–Xstrata in 2013.

After rejecting BHP’s takeover bid, Anglo went on the offensive. This is a bold, multi-billion-dollar bet on copper, now driven by surging demand from AI data centers and electrification.

The new group will be headquartered in Vancouver, aligning with Canada’s push to protect its domestic minerals sector. The companies forecast $800M in annual cost cuts, including $60M at board and HQ level. That’s “de-duplication and rationalisation” in corporate speak, usually meaning jobs cut and offices streamlined.

Expect AI, automation, and system-wide optimisation to follow closely as a survival requirement. In the next section, see our Sustainability Outlook to learn how others are putting AI to work.

Huge congrats to our friends and readers at Teck and Anglo. What a move!

US puts $1B into critical minerals supply chain

The US Department of Energy has announced nearly $1B in funding to strengthen domestic critical minerals supply chains. The programme, backed by a recent executive order, targets every stage from recovery to refining to manufacturing.

Key allocations:

$250M for coal-industry byproduct recovery

$135M for rare earth refining from tailings and waste

$500M for processing, recycling, and battery manufacturing

$40M ARPA-E programme for mineral recovery from wastewater

The push reflects a clear strategy to cut reliance on foreign processing, secure rare earth and battery materials, and reinforce US industrial competitiveness.

ECB pushes back on Omnibus

In August, ECB President Christine Lagarde warned lawmakers (.. again) against watering down CSRD and CSDDD through the Omnibus package. Proposed changes could exempt 80% of companies, leaving the ECB without the firm-level climate data it needs for risk modelling. Lagarde specified that without robust disclosure, integrating climate risk into monetary policy becomes impossible.

Omnibus was designed to boost business competitiveness. If disclosure rules are scaled back, that should be tied to clear business outcomes, for example, connecting climate risk data with monetary incentives for adaptation and resilience. Right now, the proposals lean toward blanket simplification with no such link, creating a disconnect between policy goals and actual economic benefit.

Let’s see if lawmakers respond with something more targeted.

KEY REPORTS

Sustainability Outlook: the function at an inflection point

The Sustainability Outlook 2025 shows sustainability teams are under pressure from several directions. Anti-ESG rhetoric is reshaping how sustainability is positioned. Companies are pushing for efficiency and cost optimization. And AI is rapidly automating disclosure work.

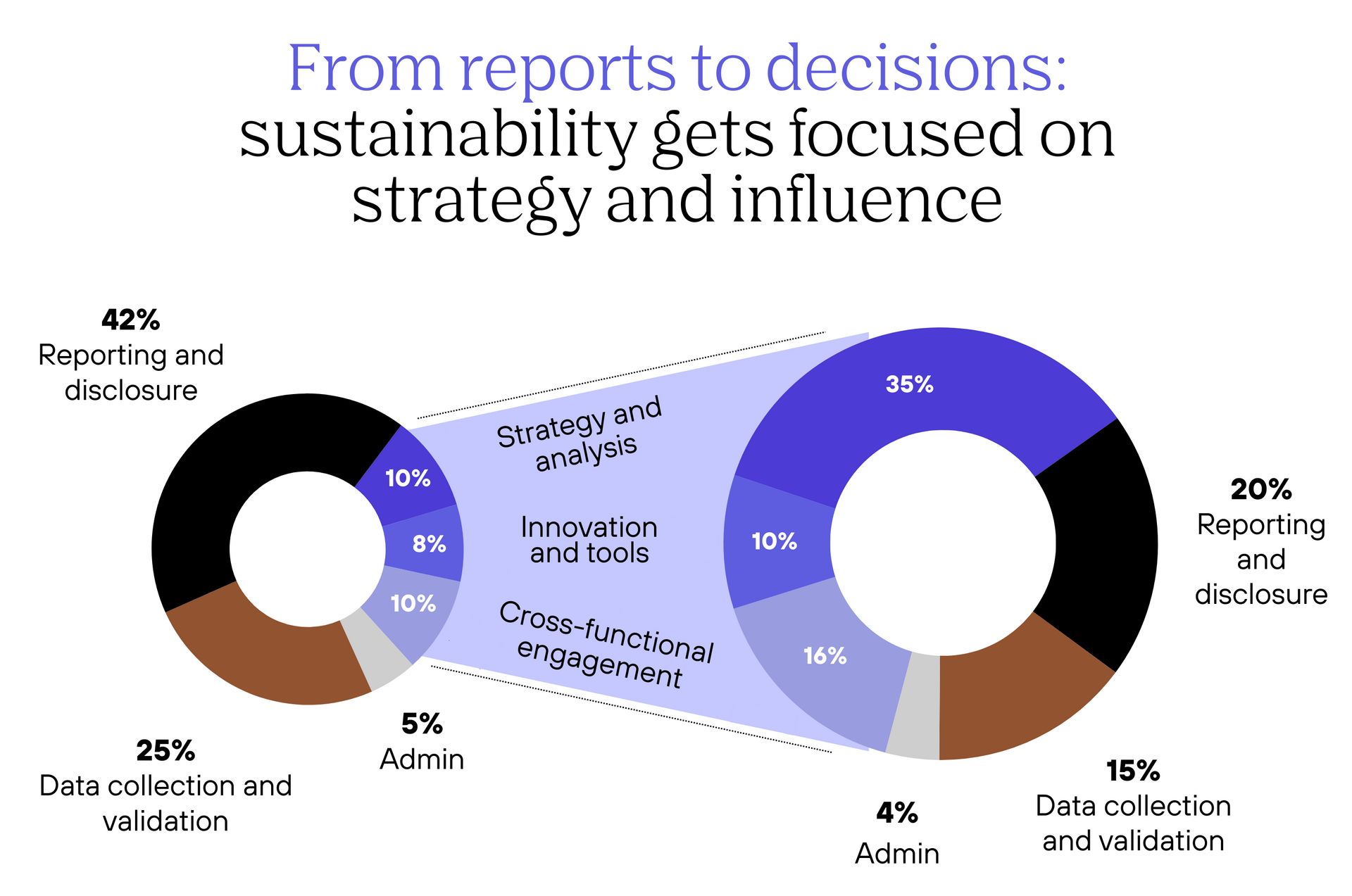

The internal picture is just as stark. Around 80% of time still goes to reporting, data collection, and administration. Only 10% is left for strategy. That imbalance keeps the function reactive, with little space to influence business choices.

The Outlook also models what a rebalanced structure looks like: time spent on strategy, innovation, and cross-functional engagement more than doubles: from 28% today to 61%. Reporting and admin shrink from two-thirds of the workload to just over a third.

Sustainability Outlook 2025

This shift is already underway in early adopters of technology-led models. Automating reporting frees capacity for activities tied directly to procurement, sales, and investment, letting sustainability teams shape margins, risk, and growth, and gain internal influence.

We’ll be speaking to leaders in the industry on this shift through a new series of webinars. The first session will focus on sustainability as a strategic function, and we’ll share the details with you soon!

Disclosure dividend 2025: environmental risk = financial risk

CDP’s Disclosure Dividend 2025 report quantifies climate risk at $38T by 2050. Behind this scary number are real and already visible effects: crop losses in Europe, rising insurance costs in the US, disrupted supply chains.

Key findings:

Up to $21 return per $1 invested in mitigation (average $7)

90% of large companies already assess risks

Suppliers with financial incentives cut emissions 52% more

The report frames disclosure as a driver of resilience, competitiveness, and access to capital. Evaluating risks is clearly valuable, but identifying them is not the same as disclosing them, and the report does not show why that extra step justifies the cost. For many teams, the effort of collecting and formatting data is already a major barrier. Under current cost pressures, the value of disclosure itself becomes a fair question.

The first step toward meaningful risk management — and eventually useful disclosure — is building a usable knowledge base. Connecting data from ERPs, spreadsheets, supplier reports, and policies allows risks to be assessed reliably and the same data to be reused for disclosure when it adds value. We outlined how to start building this foundation in our latest post on the Sustainability Twin™.

Interview: Bastian Buck on the future of reporting via Green Digest

Our friends at Green Digest spoke with GRI Chief Standards Officer Bastian Buck about the evolution of sustainability reporting. He outlined GRI’s priorities, including updated climate and energy standards, new sector guidance for finance and textiles, and reaffirmed double materiality as a cornerstone of corporate reporting.

REGULATORY UPDATES

Battery due diligence delayed: two years to get ready

The EU has pushed back raw-materials due diligence requirements for cobalt, lithium, graphite, and nickel under the Battery Regulation to August 2027. The delay gives companies more time to set up supplier traceability before compliance becomes mandatory.

For most, this 24-month reprieve is a chance to build a stronger plan: supplier mapping, grievance and CAPA workflows, third-party checks, and connect it with battery passport data to avoid duplicating work later.

For companies that already have the structure in place, the delay is a chance to move first. Early movers are using this window to get supplier evaluation and CAPA plans running smoothly. Our value chain due diligence module — already adopted by leading battery producers — makes that process faster and easier. See the update in beSirius NEWS👇.

Spain declares climate emergency and sets a mandatory climate reporting

Spain has approved a national climate emergency plan that fundamentally shifts its regulatory landscape. Starting in 2026, nearly 4,000 organizations, large companies and public bodies, must report their 2025 Scope 1 and 2 emissions, and from 2028, include Scope 3. They’ll also be required to publish five-year decarbonization strategies incorporating double materiality assessments and concrete targets.

This move follows years of record-setting climate disasters in the country (wildfires, floods) that have cost Spain an estimated €32B. Rather than waiting for EU-wide standards, Spain is acting decisively to accelerate resilience and decarbonization.

CBAM moves ahead, feedback open on key rules

The European Commission has confirmed CBAM will start as planned, despite rumors of delay. With the cost phase approaching in 2026, Brussels is now working through the details that will decide whether CBAM becomes a climate tool or just an industry tax.

A new consultation is open on the core mechanics of the system:

Calculation methodology – how embedded emissions are measured and verified

Recognition of carbon prices paid in third countries – whether and how to credit producers for carbon costs already paid outside the EU

Certificates and free allowances – how surrender obligations interact with free EU ETS allocations

The second point is critical. Without a clear, international rule for recognizing carbon costs paid abroad, EU producers will just carry extra costs. That means lost competitiveness, more imports from higher-carbon countries, and zero climate benefit.

Earlier this summer, the Commission also launched a consultation on extending CBAM to downstream steel and aluminium products, adding anti-circumvention rules, and revising the electricity sector approach.

Industry needs to weigh in. If CBAM is to strengthen European industry rather than kill it, the design has to be practical and globally consistent. Silence now means higher costs and higher emissions later.

Links to the consultations

MEME OF THE MONTH

We all struggle to find the right words to describe our impact.

So here is your Sustainability BS Statement Generator instead. Now you can sound strategic without saying anything at all.

beSIRIUS NEWS

[Released]: Due Diligence without Excels

By now you know I hate ESG questionnaires. The very first idea for beSirius came from being on the supplier side: drowning in forms, wondering what the questions even meant, sending them back into a black hole… and never hearing back.

So once we solved that problem — making it simple to respond to any questionnaire, in any format, in any language — we turned to the other side of the pain: the buyers. The ones buried in thousands of responses, who can’t tailor every questionnaire to every supplier, who don’t have time to call every supplier, who spend weeks chasing answers or trying to make sense of what came back.

The beSirius Due Diligence Module applies buyer’s risk logic across suppliers, then shows results in portfolio-level heatmaps, so the team sees where to focus attention. Every assessment is evidence-backed and audit-ready, with automated follow-ups for high-risk suppliers. So teams can focus on building stronger, meaningful relationships with suppliers instead of combining Excels.

If you’d like to see how leading battery producers and miners are already using the module, talk to us.

Where to meet us

Here are the events we will be speaking at and attending in the coming weeks.

Ethics, Compliance and AI by WIM UK and Anglo American

📍London, UK — 17 September

I’ll be speaking on how AI is reshaping ethics and compliance in mining. Drawing on our work with leading producers, I’ll cover how top companies are balancing AI’s opportunities and risks, what compliance teams need to watch, and the strategies that make implementation work. Register here.

Sustainability in Metals Forum (Triland)

📍 London, UK — 15 October

I’ll join peers from Vale, LME, and Umicore to discuss how sustainability is moving from reporting to driving contracts, financing, and strategy, with practical examples from our work at beSirius. Register here.

FT Live Metals & Mining Summit 2025

📍 London, UK — 9–10 October

LME Week

📍 London, UK — 13–15 October

Responsible Business Annual Conference

📍 Maryland, US — 11–14 November